The Dynamics of Nvidia Stock Business on the Market

An Overview of Nvidia Stock on the Market

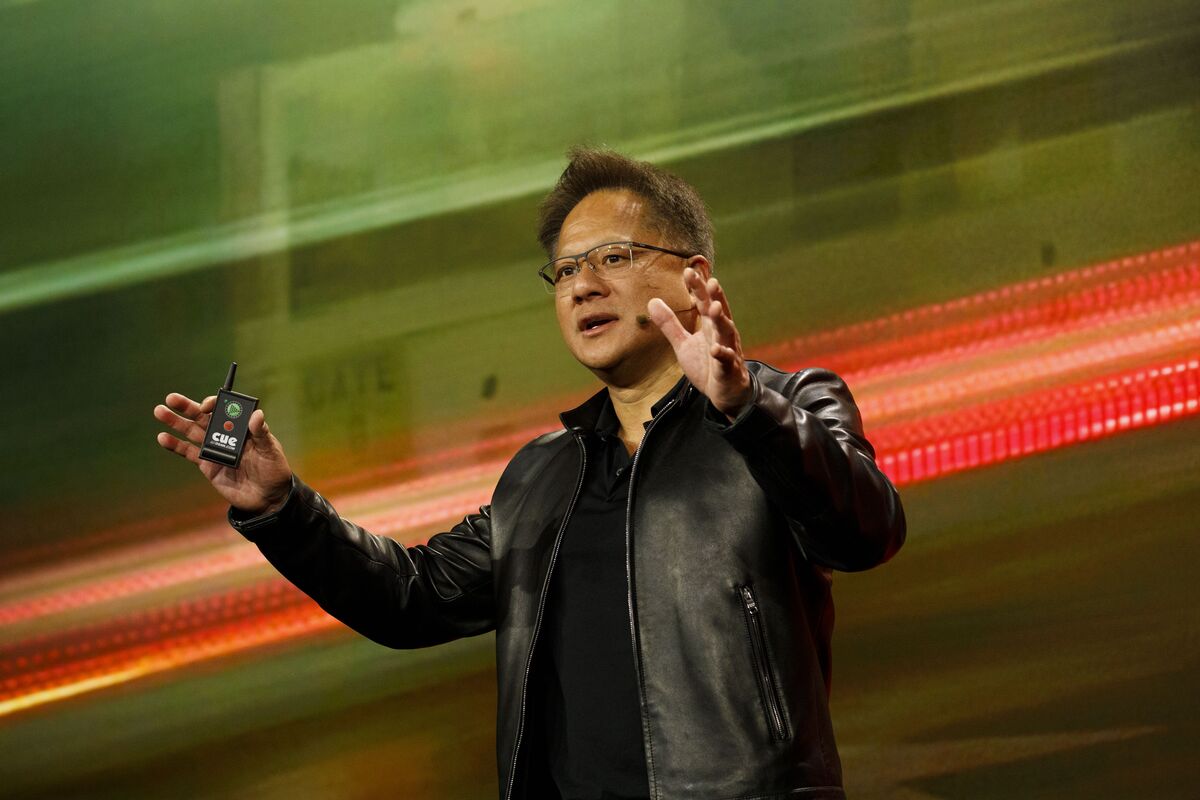

It won't come as a surprise to investors that Nvidia stock (NASDAQ: NVDA) is one of the hottest stocks on the market right now. The San Jose-based chipmaker has seen its market cap surge by more than 400% over the past three years. Nvidia is now one of the most valuable companies in the tech sector, and its shares are highly sought after by both individual and institutional investors. But what exactly is driving Nvidia's success?

Nvidia's Many Growth Drivers

Nvidia's meteoric rise can be attributed to a variety of factors. First and foremost, the company has a successful business model, which is underpinned by its GPU technology. GPUs are highly sought after in the gaming, virtual reality, and AI industries, and Nvidia is well-positioned to capitalize on these trends. What's more, the company has made big strides in the data center market, as well as in the automotive and healthcare sectors.

In addition, Nvidia has made a series of strategic acquisitions over the past few years, including Mellanox, and the company's R&D spending has been skyrocketing. This has allowed the company to develop and launch a range of cutting-edge products. In addition, Nvidia's brand name and marketing prowess have contributed significantly to its success.

Exploring the Technical Side

From a technical standpoint, Nvidia stock is currently in an uptrend, and it appears to have strong support at the $400 level. Its Relative Strength Index (RSI) is currently at 74.9, which indicates that it is overbought. That being said, the stock still appears to be headed higher.

At the same time, Nvidia's earnings growth has been impressive. Its trailing 12-month earnings per share (EPS) is currently $9.36, up from $3.74 a year ago. Its forward PE ratio is currently at 35.9, while its price to free cash flow ratio is at 37.5. These metrics suggest that, in the short-term, the stock is likely to remain strong.

Conclusion

Nvidia stock has been on an impressive run over the past few years, and its success is driven by a number of factors. The company has a successful business model, strategic acquisitions, and strong brand recognition. What's more, technical indicators suggest that the stock appears to be headed higher. However, it should be noted that the stock is currently overbought, and investors should proceed with caution.